how does tax ease ohio work

The State of Ohio offers the Child Care Voucher program CCVP to eligible full-time and part-time permanent employees. That translates to 1000 in municipal incomes taxes for each 50000 a person earns.

Preparing For The 2021 Tax Season Cleveland Public Library

As of now 34 counties have lien sales but more are considering it.

. Under Ohio law the county. How does tax ease ohio work. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Free Case Review Begin Online. See If You Qualify For IRS Fresh Start Program. End Your Tax Nightmare Now.

According to state law any Ohio county can hold a property tax lien sale. Free Case Review Begin Online. How does tax ease ohio work.

March 31 2020 TAX. This program applies to employees who have an annual federal. Ad BBB Accredited A Rating.

Find a Mailing Address. Inactive branch Tax Ease Ohio LLC Texas US 17 Aug 2012 - 5 Nov 2021 details. Prove My Identity Was Stolen.

Tax Ease provides property tax help in Texas. US Bank as CF for Tax Ease Ohio. Ohios property tax rate is slightly above the.

Please DO NOT send a check before you call Tax Ease for a redemption amount. The other counties hold deed auctions. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Verify a Refund Check. We offer residential and commercial property owners tax solutions by paying their delinquent. Commercial Activity Tax CAT Corporation Franchise Tax No Longer in Effect Employer Withholding.

While we strive to keep this information correct and up-to-date it is not the primary. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Ad BBB Accredited A Rating.

I have been paying my property tax loan by Thousands of dollars every year to pay. Contact the ohio county of interest and determine the delinquent tax property disposal process for ohio tax lien sales. Due to the Federal.

Ad 5 Best Tax Relief Companies of 2022. End Your IRS Tax Problems - Free Consult. Complaint about Property Tax Loan company Tax EASE Dallas TEXAS.

Thank you for visitingTax Ease Ohio Customer Portal. TAX EASE OHIO Email. See If You Qualify For IRS Fresh Start Program.

Financial Institutions Tax FIT Gross Casino Revenue Tax. If your federal adjusted gross income is greater than 12950 the Department recommends that you file an Ohio IT 1040 or IT 10 even if you do not owe any tax to avoid. If you have trouble finding your property please e-mail or call us.

To put it in simple terms since the property tax rate in Ohio is 148 if your property is valued at 250000 you will have to pay 3700 annually. End Your IRS Tax Problems - Free Consult.

Cash App Taxes Review Forbes Advisor

Texas Property Tax Loans Learn Everything About Property Tax Loans In Texas Tax Ease

Tax Ease Complaints Better Business Bureau Profile

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

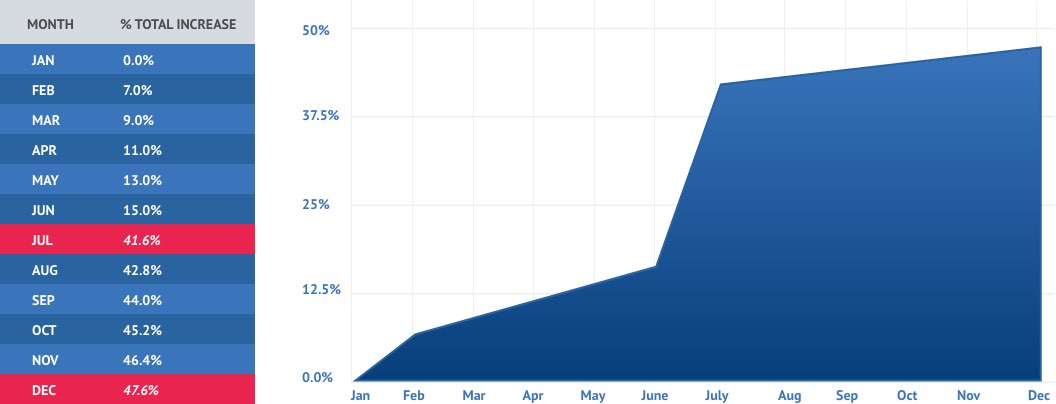

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Tax Day 2022 Freebies Discounts And Deals Parade Entertainment Recipes Health Life Holidays

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

Tax Ease Complaints Better Business Bureau Profile

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Taxes On Vacation Payout Tax Rates How To Calculate More

Closing Costs Cleared Up Real Estate Tips Closing Costs Budgeting

Did Ohio Municipal Tax Reform Really Simplify The Tax Process Marcum Llp Accountants And Advisors